Shayre Academy of Financial Literacy

Gathering and Sharing the Collective Wisdom and Insight of Intellects, Progressives, Economic Realists, Poets, and Storytellers

Tuesday, October 8, 2013

Sunday, June 5, 2011

You Don't Know What You Don't Know - Part 1 of 2

My hope is that this will be seen as the logical sequel to the movie, Inside Job, by Charles Ferguson, which can be viewed here.

The blog entry/post below (You Don't Know What You Don't Know, Part 2)includes all the emails I have sent, and received from the likes of Mark Carney (Governor of the Bank of Canada), Minister of Finance, Jim Flaherty, and the CEO's of Vancity, Coast Capital, Envision, and Prospera Credit Union.

You Don't Know What You Don't Know - Part 1 - Must see interviews: PIMCO's Bill Gross, Nouriel Roubini (an economist who saw the financial crisis coming in 2007), and George Magnus of UBS Investment Bank.

You Don't Know What You Don't Know - Part 2 - Why the economics of 1982 to 2007 no longer apply.

You Don't Know What You Don't Know - Part 3 - Why economics of 1982 to 2007 no longer apply, continued.

You Don't Know What You Don't Know - Part 4 - Alan Greenspan - "No need to regulate fraud."

You Don't Know What You Don't Know - Part 5 - How the U.S. pulled off the greatest fraud in history.

You Don't Know What You Don't Know - Part 6 - Peak Credit and The Housing Bubble - Implications.

You Don't Know What You Don't Know - Part 7 - U.S. Political Duopoly and The Housing Bubble Explained.

You Don't Know What You Don't Know - Part 8 - A must-watch inspiring speech on humanity's potential - and my outlook on life.

You Don't Know What You Don't Know - Part 9 - US Middle East policy explained.

You Don't Know What You Don't Know - Part 10 - Obama - a Progressive with a plan - so, don't worry.

You Don't Know What You Don't Know - Part 11 - Ask your financial advisor if this is true.

You Don't Know What You Don't Know - Part 12 - - Questions I asked Coast Capital and Vancity CEO's.

Coast Capital, Vancity, Prospera, and Envision called on the carpet (and sadly disappoint) - 1 of 2 - This is a MUST SEE. I apologize that original footage from the Coast Capital AGM could not be used. Please do not underestimate the seriousness of this video just because the "re-enactment" isn't as powerful as the original AGM video footage. There really wasn't anything else I could do.

Original video I posted on YouTube included video footage from Coast Capital AGM, which

Coast Capital's lawyer has ordered me to immediately cease and desist from reporting.

(They also demanded that YouTube remove the original video from their website.)

Coast Capital, Vancity, Prospera, and Envsion called on the carpet (and sadly disappoint) Part 2 of 2

Credit Unions (Coast Capital, Vancity, Prospera, and Envision) fail their members, and the community at large - Part 1 of 2 - They could have done so much good!

(This is the original video taken down by YouTube at Coast Capital's request)

Credit Unions (Coast Capital, Vancity, Prospera, and Envision) fail their members, and the community at large - Part 2 of 2 - They could have done so much good!

(This is the original video taken down by YouTube at Coast Capital's request)

You Don't Know What You Don't Know - Part 2 of 2

(Click on them to get a more readable copy. If you still cannot read it, increase the zoom on your computer, or print out the picture.)

Another link I hope you will find informative.

Have You Herd? Your Adviser Is Scared to Set You Straight - Wall Street Journal

...instead of holding your hand, some advisers might prefer to pull you by the hand in the direction you are already headed.

In 2008, researchers led by Antoinette Schoar, an economist at the Massachusetts Institute of Technology, trained two dozen mystery shoppers in the basics of investing. Masquerading as potential clients, the shoppers had initial meetings with nearly 300 financial advisers in the Boston area.

Each "client" showed up with a portfolio and a preferred investing strategy. About a third pretended to like chasing hot returns.

"Instead of undoing or leaning against that bias," says Prof. Schoar, "advisers were actually very supportive of chasing past returns." The more a prospective client had pursued hot performance, says Prof. Schoar, the less likely the average adviser was to suggest a different approach.

"Chasing past returns is kind of a nice bias from an adviser's point of view," she adds. "It generates more fees"—especially for advisers who earn commissions each time they sell stocks or mutual funds.

One danger is that if you voice a strong opinion, your adviser might not give you a second opinion. He might merely echo your own, making you think he is smart because he agrees with you—and clearing the path of least resistance to his next commission. Sometimes, acting like a sheep just pays better.

Sukh's Thoughts: And by letting you chase past returns, not only does the advisor "earn" his or her commission by just doing whatever makes you happy, but when these "investments" disappoint, they get to tell you that you only have yourself to blame, because this is what you wanted to do.

Please take the time to go through all the entries I have posted on this blog. I think investors need to know this information as we go forward into an era where buy-and-hold will only be profitable for those that sell you the mutual funds, and those that manage the mutual funds. Those that actually invest in them, well, they're likely, over time, to become very disappointed with their investments, and unfortunately will most likely sell at the exact wrong time (only when they have lost complete confidence in the "advice" they get from the person that sold them these mutual fund "investments").

The content on this site is provided as general information only and should not be taken as investment advice. All site content shall not be construed as a recommendation to buy or sell any security or financial product, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author.

Thursday, February 17, 2011

Saturday, January 22, 2011

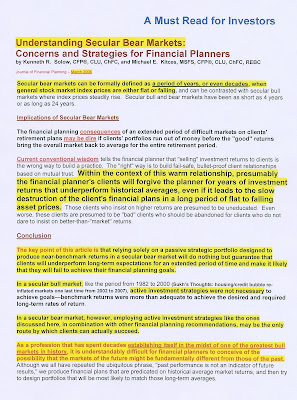

Why has your financial advisor never explained the damage a secular bear market can do to your life savings?

Secular bear markets destroys wealth, but advisors rarely explain them to clients as that would not be good for the advisor's business (commissions).

The pages linked below are critically important to your financial well-being. Please, click on them and print them out.

John Maynard Keynes: "A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him."

John Maynard Keynes: "A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him."Sukh's Thoughts: I believe this also applies for financial advisors and how they manage people's life savings. Buy-and-hold-and-buy-some-more-on-the-dips worked very well for everyone in a secular bull market, but in a secular bear market, investors will get killed, while "advisors" continue to "earn" their commissions.

Advisors will do what they have to do to put food on their own families' tables, that is just human nature. And, they have the cover of being able to say that they are only doing as they have been trained. Unfortunately, all their training assumes a never-ending secular bull market and an economy where incomes are always rising and interest rates are always falling.

This is no longer the reality we live in.

Advising clients in a secular bear market is not something most financial advisors are qualified, or prepared to do, so they keep their blinders on, and make no effort to educate themselves or their clients of this new reality. Besides, doing so would only open them up, to not only losing business (because they would have to tell their "clients" things they need to know, but do not want to hear), but also to lawsuits for negligence. By sticking with the buy-and-hold, think long-term approach, they at least have the legal cover of being able to say, "Nobody saw it coming!"

Jeremy Grantham: "Career risk drives the institutional world. Never, ever be wrong on your own. You can be wrong in company; that's okay. For example, every single CEO of, say the 30 largest financial companies failed to see the housing bust coming and the inevitable crisis that would follow. Naturally enough, "Nobody saw it coming!" But in general, those who danced off the cliff had enough company that, if they didn't commit other large errors, they were safe; missing the pending crisis was far from a sufficient reason for getting fired."

Jeremy Grantham: "The surge of bailout money certainly prevented the market from going as low this time as would have been justified by the severity of the crisis. Based on history, an appropriate decline would have been into the 400s or 500s on the S&P.

Sukh's Thoughts: The next time the market crashes (maybe sooner than most people realize), and interest rates are already low, there will be nothing to inflate the market back to bubble valuations. And this time around, investors will be told that they really should have known better (based on what happened just a few years earlier and the fact that we are in the middle of a once-in-a-lifetime financial/credit crisis), and the losses incurred are the risk you take when investing in corporate equities and bonds.

A Minsky moment is the point in a credit cycle or business cycle when investors have cash flow problems due to spiraling debt they have incurred in order to finance speculative investments. At this point, a major selloff begins.

Charles Ferguson: "There has evolved a political duopoly in the United States, in which the two political parties agree to agree on certain things and agree to disagree on others. And, in particular, they agree on things related to finance and money and they disagree on social policy....My quite strong sense is that this is something that is now explicitly understood.

A secular bear market can last between ten to twenty years, with the market worth less at the end of all these years than it was at the beginning.

Buy-and-hold works in a secular bull market. It fails miserably in a secular bear market.

Finacial advisors are salespeople that pay their bills by selling products, not advice. There is often a huge agency problem that is never mentioned to "clients". How else could they possibly recommend a buy-and-hold strategy in a market where the long-term trend is down?

The question is, in a secular bear market, and especially when we are currently in the middle of a once-in-a-century financial crisis, who exactly is best served by such a superficial level of advice?

The question is, in a secular bear market, and especially when we are currently in the middle of a once-in-a-century financial crisis, who exactly is best served by such a superficial level of advice?

Why are financial advisors not properly educating their clients?

Why are financial advisors not properly educating their clients? Investors need to be better informed so that they can make more prudent investment choices when it comes to preserving their life's savings in a secular bear market.

This is the right thing to do, but it's very bad for business in the investment "sales" industry!

Debt default, deleveraging, and asset-price deflation will have an immensely negative effect on the value of people's investments? (especially after all the different mutual fund fees for "professional management" are taken into account)

Debt default, deleveraging, and asset-price deflation will have an immensely negative effect on the value of people's investments? (especially after all the different mutual fund fees for "professional management" are taken into account) According to the debt deflation theory, a sequence of effects of the debt bubble bursting occurs:

1.Debt liquidation and distress selling.

2.Contraction of the money supply as bank loans are paid off.

3.A fall in the level of asset prices.

4.A still greater fall in the net worth of businesses, precipitating bankruptcies.

5.A fall in profits.

6.A reduction in output, in trade and in employment.

7.Pessimism and loss of confidence.

8.Hoarding of money.

9.A fall in nominal interest rates and a rise in deflation adjusted interest rates.

Please, get better informed!

Live, Love, Laugh, Learn, Leave a Legacy!

The content on this site is provided as general information only and should not be taken as investment advice. All site content shall not be construed as a recommendation to buy or sell any security or financial product, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author.

Friday, January 21, 2011

Beware of those who only get paid when they gamble with other people's money!

"The market's going to come down, probably in an orderly manner, with animal spirits fairly high, and the economy and profit margins doing pretty well. It often happens that way. But if we just go roaring through on a spluttering economy, with all the money flowing into speculation, the way it does now, the way he's (Bernanke) begging us to do incidently, then, come eighteen months from now, we're set for another bust and the piggy bank is empty. If we have another bust, what do we throw at that one compared to the last one or the one before? - Jeremy Grantham - May 2010

"It's very tempting, and this is what the Fed wants by the way, it wants us to go out there and buy stocks which are overpriced because bonds, they have manipulated into being even less attractive. So, we're being forced to choose between two overpriced assets....And what the Fed is trying to do is to make cash so ugly that it will force you to take it out and basically speculate. - Jeremy Grantham - November 2010

"But I think if you're willing to speculate, you might find this is an interesting one more year, to speculate, but be aware, the ice is thin, it's overpriced, it's a dangerous game, don't believe that it's somehow justified. It is not justified by anything except the crazy behaviour of the Fed." - Jeremy Grantham - November 2010

"So, in the end, Uncle Alan and his interest rate heroics only postponed the inevitable. Perhaps it will be the same again. The surge of bailout money certainly prevented the market from going as low this time as would have been justified by the severity of the crisis. Based on history, an appropriate decline would have been in the 400's or 500's on the S&P." - Jeremy Grantham - January 2011

Sukh's Thoughts:

You've done well by holding on to your investments as the central banks have done all they can to reflate the asset bubbles without correcting the underlying problems.

Is it possible that the next time the market crashes and the central bankers can't reflate it because interest rates are already too low, they will tell you that you only have yourself to blame because you should have known the risks considering what happened in 2008?

And the reality is, your advisor should have known about the risks and explained them to you, but if they did that, they would be out of a job themselves.

This is the agency problem that George Soros speaks of.

Those advising you will be forced to put their own interests ahead of yours. To not keep you fully invested in the markets at all times is to lose their job and their livelihood, and nothing will be gained because the next advisor responsible for "helping" you "manage" your money will put you right back in the markets again anyways.

So, it is almost impossible for a financial advisor to make the decision on principle alone, as that would also mean financial ruin for him and his family.

In today's economy, what other job will he (she) be able to find to put food on the table and pay the bills? So, begrudgingly, they do what they must do, in essence, taking little bits in the way of trailer fees and commissions from the many people that entrust them to manage their life savings.

The conventional pre-1950′s thinking was that, given that equities are, by nature, a riskier investment class than fixed income, equity needed to pay out greater than fixed income returns to over-come the structural risk. After all, why would you invest in something without some cash being returned to you over the life-time of your investment (oh, how times have changed!)? Since anyone could purchase U.S. treasury note with guaranteed payment, dividend yields needed to be greater than treasury yields to entice investors to invest in equities.

How great? One researcher found S&P 500 dividend yields from the period of 1871-1967 were approximately 20% greater than AAA corporate bond yields.

February 3, 2011 – BREAKFAST WITH DAVE ROSENBERG

An illusion of prosperity has been created, but it won’t last

I hope you will take the time to click on the links below and read the material I am trying to get middle-class investors to read and understand.Home prices in the U.S. are resuming a downtrend and soon we will see the household sector having to rebuild its savings without aide from the government. The view that Washington takes care of everything will disappear with looming austerity. This year it is a state and local government story, next year it will be the federal government.

With short-term rates at zero combined with increasing food and energy prices, this is obviously bad news for savers. It is an illusion of prosperity that has been created, but it won’t last. Given the intractable nature of the U.S. fiscal deficit, the Fed needs to encourage more domestic savings but it will not, at least for now, due to near-term deflation fears.

The aim here for the Fed is a reflationary wealth effect via rising equities; buying time until the market for jobs and homes turns around on a sustained basis. The offset is the pinch to real wages from not only ongoing excess capacity in the labour market, which Bernanke does not see ending for another five years, but from the Fed’s own policies that have exacerbated the punishing run-up in food prices.

It sounds like a cliché, but I have little doubt that this cyclical bull market will end in tears. Admittedly, however, there could be more upside near-term, but a last gasp I would expect, especially now that the retail client has thrown up his/her hands, thrown in the towel, and moved back into equities after the market has already doubled. That is human nature, and it is a classic contrary signpost (as per Bob Farrell’s Rule number 5).I can go on but I have seen this movie before. It will end in further wealth destruction via a stock market blow-up or significantly higher inflation down the pike. Given the record structural deficits and the “kick-the-can-down-the-road” monetary and fiscal policies I see no other outcome. Just remember what happened the last time the Fed contemplated an exit strategy ― that, you don’t need a long memory for. It was not even a year ago and precipitated the near-20% May-June market correction.

De-leveraging - Fairy Tale Ending?

Ultimately, “all the king’s horses and all the king’s men” cannot prevent the de-leveraging of the financial system under way. The extent of de-leveraging is substantial and likely to take time. In recent years, money was cheap and other assets were expensive. As each of the global economy’s credit creation engines breaks down and systemic leverage reduces, money becomes scarce and more expensive, triggering substantial adjustments in asset prices in a reversal of the process.

At best, the government and central bank actions can smooth the transition and reduce the disruption to economic activity in the transition to a lower-debt world. The risk is that well-intentioned steps prevent the required adjustments from taking place, delay recognition of problems and discourage action that must be taken by financial institutions, corporations and consumers.

The Imagination Trade, or the Tinkerbell Market 2.0

"So enjoy the ride while it lasts. As with the credit mania of 2007, investors will assume they can get through the exits when the party stops. And some did, but many were trampled in the ensuing panic."

The Future Belongs To the Adaptable - Nicole Foss

Our position is that being in cash on the sidelines is by far the safest option at this point, and where most people would be better off by far. Those who are still in the markets are playing a very dangerous game. Many of them know this perfectly well, but they can't walk away from the casino. The upside is limited, possibly very limited, and the risks are steadily increasing.

Stock market bubbles (and housing bubbles etc) are ponzi schemes. As with all ponzi schemes, only a few manage to cash out, and the majority are those who do so early. Those who do not cash out become the designated empty bag holders, but that empty bag can look awfully attractive at a market top. Trying to catch the top tick, and wring every last ounce of profit out of a collapsing system, is foolish. Most investors who play that game are likely to lose badly.

They may be convinced that they are clever and quick enough to get out before the rest, but the odds are not good. Also, the rules of the game are likely to be changed along the way, so that one would have to be both right and lucky in order to profit. For instance, shorting is likely to be banned at some point, and speculators demonized. There will be opportunities to make a killing, but many more 'opportunities' to lose your shirt.

Capital preservation is essential in a deflation, and the best way to preserve capital at this point is to be liquid. Cash constitutes uncommitted choices, and in a world of uncertainty, one needs to be flexible. There will be plenty of opportunities over the next few years (both to improve circumstances and avoid disaster) that will only be available to the few who still have the options cash provides. It isn't necessary to have a fortune. Even a small amount of cash can go a long way as deflation causes prices to fall.

Borrowing Returns from the Future - John Hussman

If a return of 3.3% a year (which includes dividends) is what John Hussman sees for the next ten years , what does that leave in the pockets of mutual fund investors after fees? The potential reward does not seem to justify the potentially huge downside risk.

Crisis 2011 - The Other Shoe - Eric Janszen

Market Ingoring Major Problems - Comstock Partners

The Botox Economy - Satyajit Das

Things I Believe - John Hussman

Illusory Prosperity - John Hussman

America Appears To Be Trapped in a Massive Coverup of Control Fraud and Corruption

PM told risk of new GFC significant

Low-wage jobs dominated hiring so far in job market recovery

Albert Edwards, SocGen bear, takes a bite out of China

What Happens When Global Liquidity Dries Up?

Can an ETF collapse?

Michael Lewitt said, "The differential between liquidity at the ETF level and liquidity at the level of underlying stocks owned by the ETF is a recipe for disaster."

Deborah Fuhr - "Product developers are working to fit funds into the ETF wrapper, without maintaining the basic features of an ETF. If this is allowed to continue, we risk confusion, disappointment and disillusionment, which could be very negative for the industry."

Morgan Stanley Challenges "ETF Collapse" Theory

“Under the terms of the authorised participant agreements signed between issuers and brokers, the issuer usually has the right to refuse a redemption for a period of time if it would be disruptive to the fund. The authorized participant would be told that they could not redeem the entire position but would be required to leave a small number of shares outstanding to allow the fund a few days to resolve the situation in a fair and orderly manner for all parties,” says Tagliani.

Sukh's Thoughts: But if short-sellers are unable to cover, how could all ETF holders possibly be made whole? This, and a retail investor mass exodus out of misunderstood commodity ETFs could crush commodities and wipe out many retirement savings plans.

Remember, commodities are an input, and if people can't afford to buy the end product, demand for commodities will collapse! And today, we have a reality of high unemployment, debt-deleveraging through default, and people's unwillingness to go further into debt, paying down debt, and saving more. This combined with a world of overcapacity and falling wages is not a good sign for attaining the never-ending growth the economy needs to stay afloat and make good on its debts and promised entitlements.

Don't Expect Miracles from Monetary Policy

"QE1 didn't work, QE2 didn't work, QE12 won't work." - Stephen Roach

A "Balance Sheet" Recession - Richard Koo

Japan was able to climb out because the rest of the world was still in a credit-fuelled Ponzi expansion. They had the tailwind of the fraud-induced US housing bubble to help them out. The US economy is four times larger than Japan's and the US dollar is the world's reserve currency. There is no economy large enough to bail out the US (and the rest of the world). So, the governments of the world will do all they can to make it look as though they did their best, but there really isn't anything we can do to kick the can down the road that much longer. There has to be a limit as to how large central bank balance sheets will be allowed to expand, and how much inflation exporting nations can absorb. Things will boil over sooner than most people realize.

The Debt-Deflation Theory of Great Depressions - Irving Fisher

Benjamin Graham: "Speculators often prosper through ignorance; it is a cliché that in a roaring bull market knowledge is superfluous and experience is a handicap. But the typical experience of the speculator is one of temporary profit and ultimate loss."

John Maynard Keynes: "The market can remain irrational longer than you can remain solvent" - Keynes' learned his lesson as a result of steep losses that resulted from holding a poorly diversified portfolio - apparently on margin - during a market plunge, years after the Depression trough of 1932. As biographer Robert Skidelski observes, "In the year of the 'terrific decline' which had started in the spring of 1937, he lost nearly two-thirds of his money." - John Hussman

Please, get better informed!

Live, Love, Laugh, Learn, Leave a Legacy!

The content on this site is provided as general information only and should not be taken as investment advice. All site content shall not be construed as a recommendation to buy or sell any security or financial product, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author.